Why OPay APK is a must-have?

In the digital landscape of financial services, one name stands out as a game-changer in especially Nigeria - OPay APK. Boasting tens of millions of loyal users, OPay has solidified its position as a leading financial service company in the country, and here is why.

What is OPay APK all about?

OPay is a free online payment app by OPay Digital Services Limited. It’s very similar to e-wallets such as PayPal, JazzCash, Venmo and others, since it lets you pay bills, transfer money and more. BlueRidge Microfinance Bank powers it and is currently only available in Nigeria.

There are millions of Nigerians using it, and more than 500,000 agents that use it to send and receive money. The company positions itself as an alternative to traditional banking, and the app allows you to easily perform all banking-related functions, including a fast and reliable network uptime.

Advertisement

Key OPay features

What does set apart OPay? At its core, OPay aims to democratize financial services through technology, providing secure, affordable, and user-friendly solutions. The platform offers an array of enticing features that cater to users' financial needs with remarkable ease:

- Instant account opening & welcome bonus: Accessible and instant, welcoming users with added incentives.

- Seamless transfers: Instantly move money hassle-free.

- Airtime/Data top-ups with Cashback: Rewards for staying connected.

- OWealth Balance with daily interest: A unique way to manage funds with daily interest accrual.

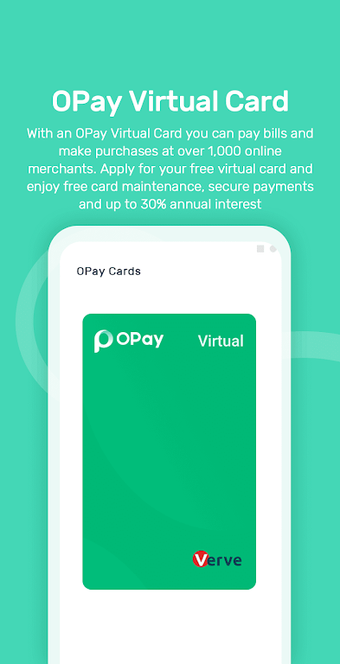

- Reliable debit card: Free of charges and universally accepted.

- Quick qustomer service: Accessible online or through physical channels for prompt assistance.

The seamless experience

OPay collaborates with BlueRidge Microfinance Bank to offer a smooth banking experience that goes beyond transactions, aiming to maximize financial potential. It's easily accessible—no bank account is necessary; users can access services with just a phone number and valid ID.

The app boasts a user-friendly interface despite its range of functions, and it covers diverse financial needs, from payments to investments, making it a versatile platform.

Is OPay for Nigeria only?

OPay primarily operates in Nigeria, focusing on catering to the financial needs of users within the country. However, OPay Digital Services Limited is a company founded by Opera Norway AS Group with footprints in emerging markets across Asia, Africa and Latin America in countries like Mexico, Nigeria, Egypt and Pakistan.

Which African countries use OPay?

OPay boasts a whopping 15 million customers in Africa, spanning across Nigeria, Kenya, Tanzania, and a bunch of other African countries.

Can OPay pay internationally?

OPay, a provider of payment, ride-hailing, food delivery, and loan services, has received approval from the Central Bank of Nigeria (CBN) to initiate international money transfers. With this approval, OPay can now facilitating B2B, B2P, and P2P remittance services into Nigeria.

A must for Nigerian e-payments

Even if you're accustomed to other payment methods or banking apps, OPay's breadth of features and user-friendly interface make it a standout choice. Notable perks include no maintenance fees for debit cards and a multitude of functionalities within a single app.

In Nigeria's financial scene, tools like the OPay APK aren't just something you pick; they're must-have.

.webp)